Leftover

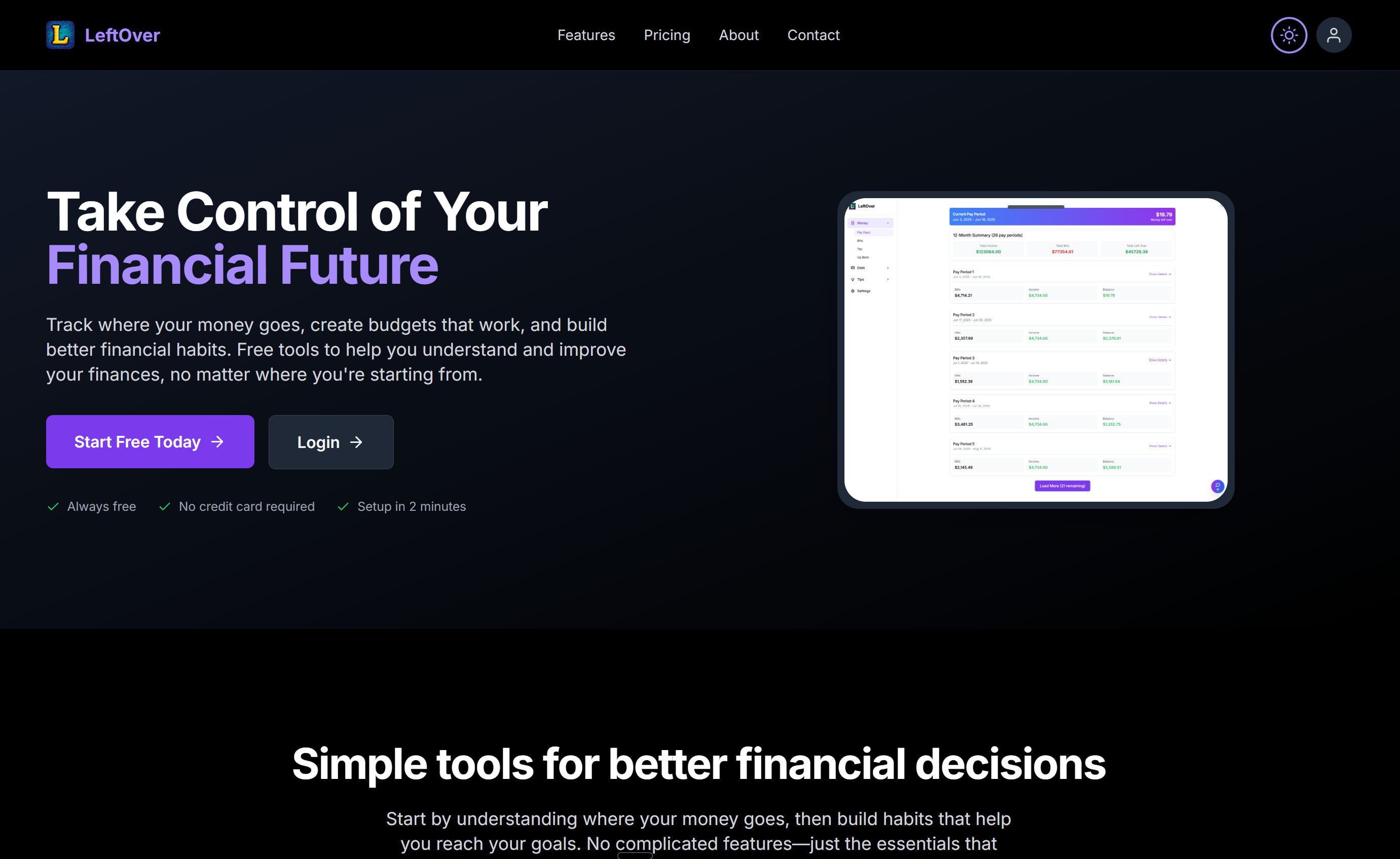

Personal Finance Management Web App

Personal Finance Management Web App

Modern, user-centric web application to simplify personal finance tracking and optimisation

Individuals struggle to monitor their income, expenses, debts, bills, and tax-deductible items in one centralised location. Traditional tools lack actionable insights and debt payoff simulations to help users maximise their "leftover" money after essentials.

Key Issue: Fragmented financial tracking leads to missed opportunities for debt freedom and poor financial decision-making without comprehensive insights.

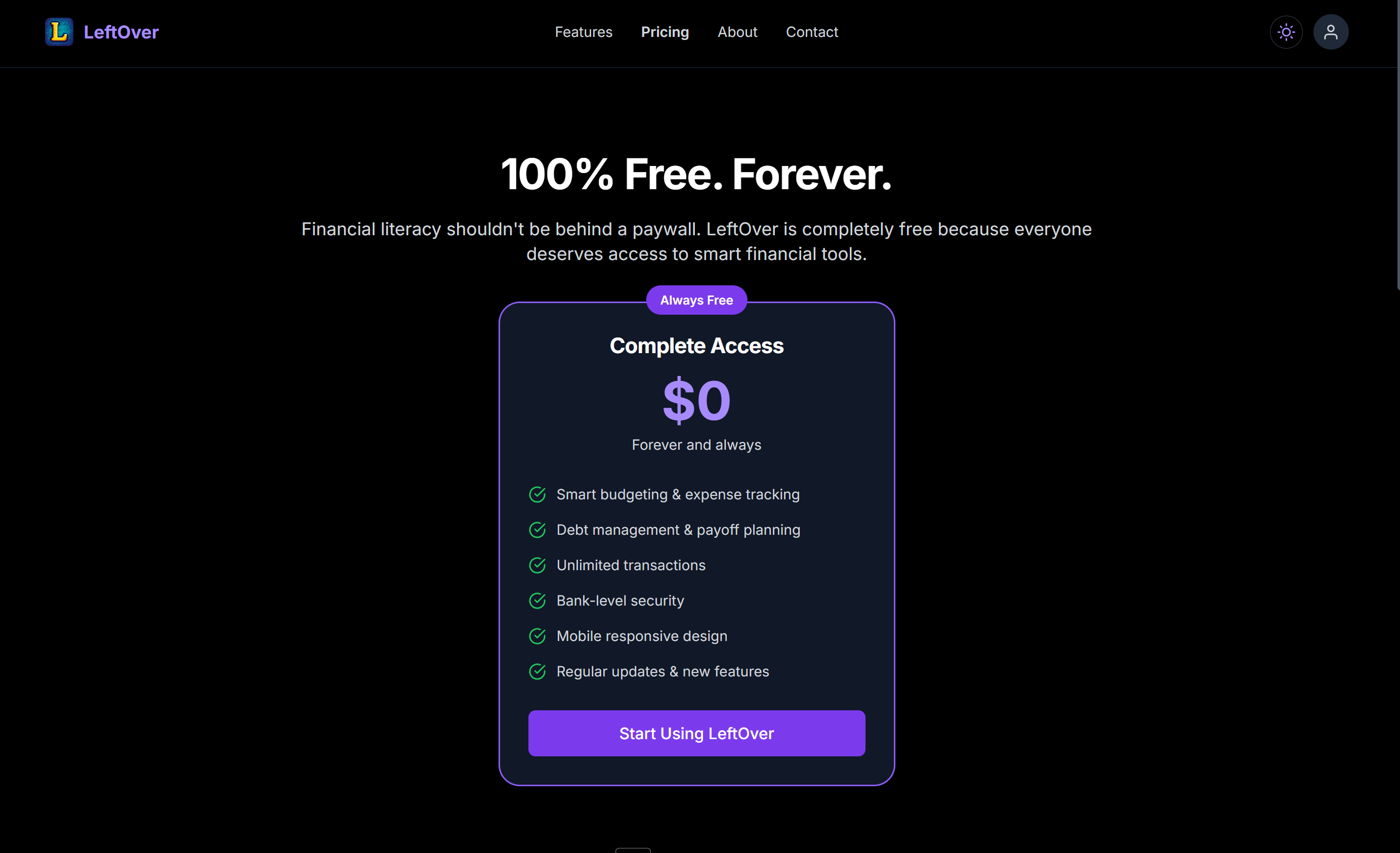

LeftOver is a modern, user-centric web application designed with a clean, dark-themed interface for seamless usability across devices. It empowers individuals to monitor all aspects of their finances in one centralised dashboard with actionable insights and debt payoff simulations.

Result: A comprehensive platform that helps users maximise their "leftover" money after essentials, accelerate debt freedom, and make informed financial decisions.

Comprehensive tools for personal finance optimization

Users input and manage multiple debts—home loans, car loans, credit cards—with details on balances, interest rates, minimum payments, offsets, and due dates. The analyser tool allows simulation of extra payments via sliders or presets ($50–$500 increments), instantly calculating time saved, interest reductions, and updated payoff timelines.

The system includes interest rate scenarios for "what-if" planning, helping users understand the impact of refinancing or rate changes. It's not just about tracking debt—it's about visualising the path to financial freedom and making informed decisions that accelerate debt payoff.

A dedicated bills section categorises recurring expenses—debt, insurance, entertainment, shared costs—across multiple categories, showing monthly totals, averages per bill, and lists of items with due dates and frequencies (monthly, annual, one-time).

Budget cycles display progress bars for current, next, and future periods, highlighting income, bills usage, leftovers, and alerts for overspending. This proactive approach helps users stay ahead of their finances rather than just reacting to what's already happened.

Users upload and organise tax-deductible receipts into categories like work-related expenses or charitable donations. Features include search, averages, and easy exports for accountants, streamlining tax preparation and ensuring nothing is missed come tax time.

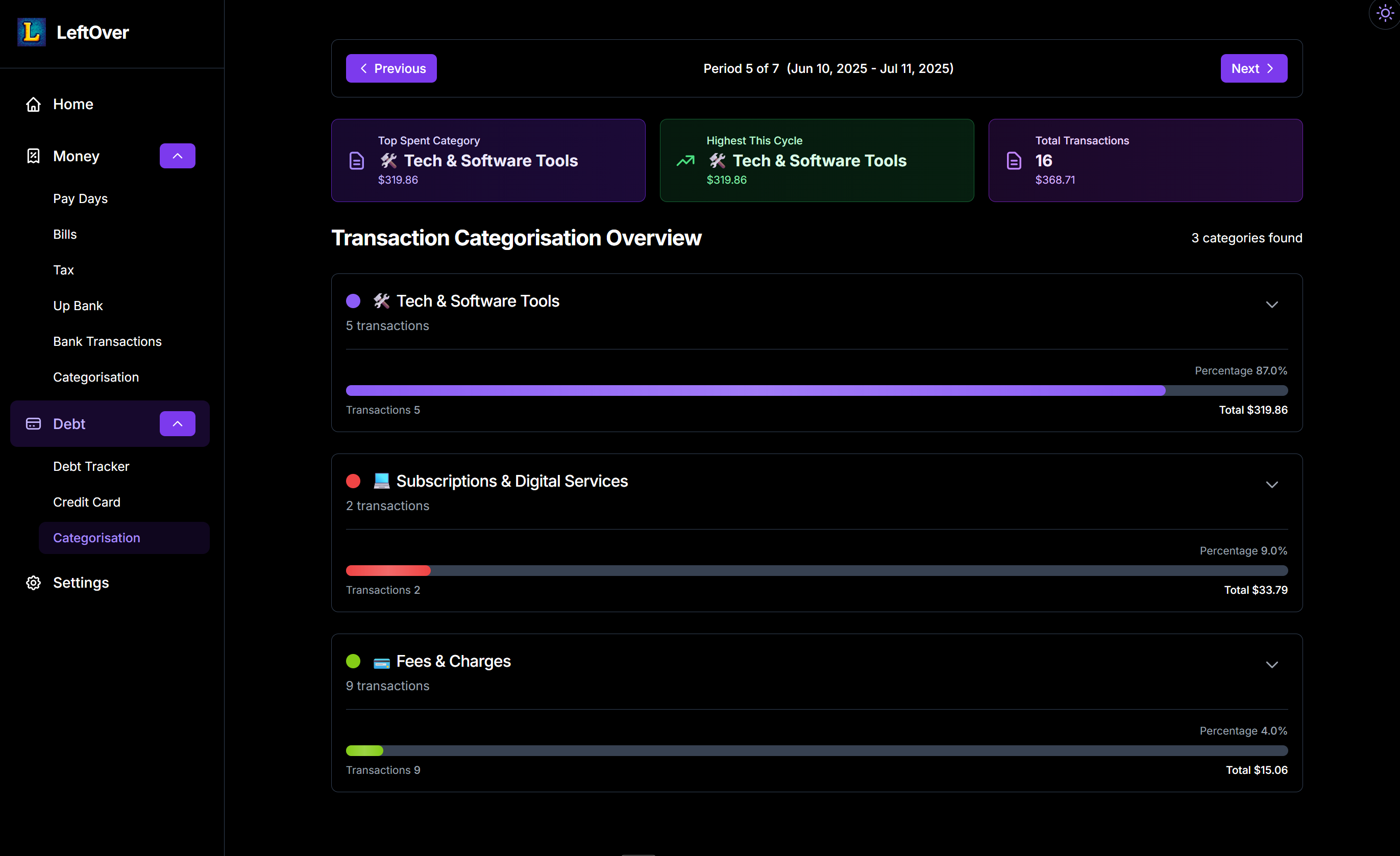

Transaction categorisation provides an overview of bank transactions by type—Shopping & Retail, Miscellaneous, etc.—with progress bars, transaction counts, and percentages for quick spending analysis. Credit card monitoring tracks all-time and periodic summaries of spending, payments, and balances, including interest-free periods and remaining balances to avoid surprises.

Designed and developed LeftOver from concept to launch, focusing on creating an intuitive financial management platform that empowers users to track debts, bills, and expenses while providing actionable insights. The project required deep understanding of financial calculations, data visualization, and user experience design for sensitive financial data.

Every aspect of personal finance, unified in one powerful platform

The money dashboard offers 12-month overviews of total income, bills, and leftovers, with visual breakdowns of billing cycles. Users see real-time "money left over" and debt-to-income ratios, helping prioritise spending decisions.

This comprehensive view transforms scattered financial data into actionable insights, making it easy to identify spending patterns, track progress towards financial goals, and make informed decisions about where to allocate resources.

An overview categorises bank transactions by type—Shopping & Retail, Miscellaneous, etc.—with progress bars, transaction counts, and percentages for quick spending analysis.

This intelligent categorisation helps users understand their spending habits at a glance, identify areas for improvement, and make more conscious financial decisions based on clear, visual data rather than guesswork.

Tracks all-time and periodic summaries of spending, payments, and balances, including interest-free periods and remaining balances to avoid surprises.

This proactive monitoring helps users avoid unexpected interest charges, stay on top of payment deadlines, and use credit cards strategically rather than letting them control their finances.

Built with modern technologies for intelligent financial management

React 19 + TypeScript + Vite

Latest React with TypeScript for type safety, Vite for lightning-fast builds, and modern component architecture for optimal performance.

Firebase Suite

Firestore database, Authentication, Cloud Functions, and Hosting for scalable financial data management and user security.

Tailwind CSS + Lucide React

Utility-first styling with modern icon library, drag-and-drop functionality, and responsive design for financial management.

Advanced State Management

Real-time data synchronization, Excel export capabilities, and comprehensive financial tracking with date-fns for time management.

Vite + Code Splitting

Advanced bundle optimization with manual chunk splitting, vendor separation, and feature-based code organization for optimal loading.

Firebase Security

Secure authentication, real-time data validation, and optimized performance with Firebase's enterprise-grade security infrastructure.

Leftover has created a new standard for AI-powered financial management, helping users make smarter financial decisions through intelligent insights and automated tracking.

Leftover demonstrates the power of combining AI with thoughtful user experience design. By focusing on real user needs and leveraging machine learning for intelligent insights, we've created a platform that makes financial management not just easier, but smarter.

If you're looking to build an AI-powered application that solves real problems with intelligent automation—let's talk about how we can bring your vision to life.

Let's create an AI-powered solution that solves your business's unique problems with the same intelligent design and engineering excellence.